The word ‘potential’ may be overused, but American cattle producers no doubt see plenty of it in the China market.

That’s because the Asian giant – which is already the largest buyer of U.S. soybeans and a major purchaser of American pork – remains in the midst of significant downswing in domestic cattle numbers and beef production. (We periodically make comments on the world beef situation; please see our article on the Brazilian cattle industry, April 7, 2016).

According to the latest numbers, China’s cattle herd in 2016 totalled just over 100.2 million head, down slightly from a year earlier and the lowest in 27 years.

In country of almost 1.4 billion people where tastes and food choices are rapidly diversifying, that represents a tempting opportunity. The trouble is, the U.S. is still essentially shut out of the mainland Chinese beef market, one of just a few international markets that never reopened to American product following the discovery of BSE in a dairy cow in Washington State in 2003.

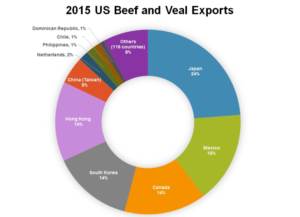

As the graph here shows, Japan, Mexico, South Korea and Hong Kong are the top destinations for US beef exports. Conspicuously absent is mainland China.

At the time of the discovery and the subsequent closing of the Chinese market, there was little impact on the U.S. industry; China had never been a big importer of foreign beef anyway. However, that all changed in 2012 when red hot economic growth and dwindling domestic production led to a sharp increase in imports.

Indeed, in July of last year, the U.S. Meat Export Federation (USMEF) reported that China was importing more beef on a monthly basis than it did in the entire 2011 calendar year. And that trend is continuing. According to USMEF numbers, China’s beef imports in 2015 amounted to 495,000 tonnes, up 56% from a year earlier. In December of last year alone, the country’s beef imports set a monthly record of 65,159 tonnes.

(In June, the USDA forecast 2016 total U.S. beef exports at 1.1 million tonnes, with exports making up about 9.6% of total estimated disappearance).

For now, U.S. competitors are cashing in, and that includes Canada, which also went through its own BSE crisis in 2003 but has since regained access to China. In fact, China became Canada’s second largest beef export market in 2015, accounting for an estimated 10% of all Canadian shipments. (The U.S. still remains far and away Canada’s largest export destination, with more than 71% of sales).

Beyond Canada, Australia remains a major beef supplier to China, although Brazil has recently taken over as the largest provider largely based on its ability to supply large amounts of the relatively cheap frozen cuts that China tends to favour. Uruguay and New Zealand are also major suppliers.

So what are the long-term prospects for the Chinese market?

On the supply side, it doesn’t appear as if China has much likelihood to expand. Its own cattle herd has been in decline for a number of years and a variety of factors suggest it will be difficult to break that downward trend; chief among them is the fact China is basically tapped out on the pasture land and forage to even feed its herd.

On the other side of the supply-demand equation, Chinese demand for beef has soared, especially with year-on-year double-digit growth in the foodservice industry and the Westernization of food retailing, particularly in urban areas, the USMEF said.

What’s also important to note is the latest beef import numbers for China don’t reflect the huge amount of beef that is illegally smuggled into the country from India, or the amount of American beef that also makes its way into the country on the sly from other export destinations, such as Hong Kong and Vietnam. So demand is ripe.

Meanwhile, a report released earlier this month by Market Reports World predicted that in the next few years, the demand for beef in China will continue to rise. Import volume of beef will also continue to grow because of the low growth of China’s beef production, it said. “There are a lot of investment opportunities in Chinese market for many global cattle breeding enterprises, beef processing enterprises and beef trade enterprises.”

To that end, it would seem the U.S. is ideally poised to fill the void. As mentioned in a previous post, American pastures on the southern Plains are on the rebound after years of drought, and American producers are now expanding their herds.

What’s needed now is just a means of finally breaking back into the Chinese market. If it can be done, it will be worth it. Last summer, USMEF president and CEO Philip Seng said the U.S.’s lack of access to China was a significant lost opportunity. And at an industry conference earlier this year in San Diego, Seng said he was hopeful the Chinese market would finally reopen soon, perhaps as early as sometime this year.

By John DePutter & Dave Milne, DePutter Publishing Ltd.

Brought to you in partnership by: