Anyone who has watched and studied cattle futures for even a brief period of time will be aware they‘re hard to predict – and extremely volatile, especially the past few years.

For cattle producers, that volatility has no doubt led to more than a few sleepless nights. After all, the stakes are huge when trying to decide when, or even if, to hedge (or forward contract) in order to lock in a market price that makes sense for your operation.

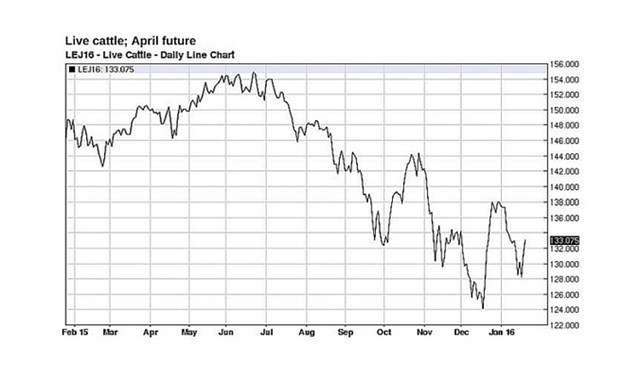

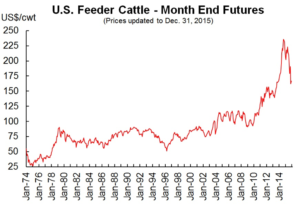

For example, from late 2009 to November 2014, nearby futures soared from the $90 area to over $170/cwt. From there the market slammed down to $120 in early January 2016.

Back in the 1990s and early 2000s, a $10 gain or break in a month would have been considered huge, and rare. Lately we’ve seen lots of $10 advances or drops just in five to 10 trading sessions.

During the massive bull market heading into late 2014, there were lots of stories throughout the industry about feedlot operators who short-hedged too soon on the way up and wound up sending millions of dollars to their brokers. Some operators cut themselves out of the best part of the bull market, never fully raking in the benefits of the super-high prices because they had hedged at lower levels.

On the other side, there were stories about operators who grew tired of hedging and contracting in the bull market and stopped doing so, just in time to get caught in the severe bear market of the past year.

The producer who regularly hedged to lock in a profit on the way up – and also on the way back down – did better. Those who ran without hedges on the way up did incredibly well and gave some back on the way down. So be it.

Of course, the operator who ran unhedged on the way up, caught the top and hedged aggressively on the way down did best.

But how many are out there who actually did that? Not a lot. It’s easy in hindsight; not so easy in reality when it`s your money is on the line.

So the million dollar question is, how do we avoid those sleepless nights; how do we maximize our returns on the way up and minimize the damage on the way down?

The first option we might suggest is taking an even, consistent approach to your marketing, regularly locking in profits when they’re available. One thing veteran market observers will probably agree on is that we tend to overestimate our ability to see the future. The solution is not to gamble and try to peg the top of the market.

Another option is to hedge carefully on a regular basis while also leaving a portion of cattle open for selective decision-making. This feeds into the desire to try one’s luck or skill at calling the market. For those who do take a selective, self-directed approach with a portion of the cattle being fed, it’s no easy task. That said, it can offer a pay-off over the course of years, given a mix of caution and savvy.

But let`s face it, marketing is a difficult game. It’s hard to assimilate the myriad of facts and opinions. Key market factors can vary from time to time. What’s noise and what’s a real market driver? There is an element of randomness in the day to day noise, the week to week ebb and flow of the market. Not only do fundamental factors come into play but also the whims of large speculators.

We are doing business in an interconnected world and it’s hard, if not impossible, to collect and successfully analyze all the factors and forces.

With that in mind, we can offer a few basic ideas from a veteran market watcher on what to look for when trying to decide what your next move should be:

- A market that can’t go up on bullish news can’t go up. If most of what you see, read and hear points up, and the USDA releases a bullish cattle-on-feed report, but futures fail to grab the news and run with it, that can be a sign of weakness. A strong case for hedging or forward contracting.

- Watch the charts. Sometimes the charts offer a pictorial of complicated, hard-to-understand fundamental forces. In their own volatile way, cattle futures will sometimes offer sharp counter-trend rallies without justification. When they stand out on the charts, sometimes that’s a hedging/contracting opportunity. (Witness the pop of more than $12/cwt in October and the similar pop in mid to late December.)

- Monitor the spreads. When deferred contract months are sharply discounted to nearbys and to cash prices, with a heavy supply of bearish forecasts built into the market well into the future, that can be a sign the market is overdoing the downside. It’s when the spreads are flat to premium for deferreds, amid seemingly-bullish information flow, that you’ll sometimes catch better hedging opportunities.

- It’s a good idea to be well informed but not overly inundated with information. Somebody once said “information is power.” Maybe not – sometimes too much information just serves to confuse. Sometimes you can drown in knowledge that doesn’t help the decision making process. Besides, over-studying the markets sometimes builds overconfidence and errors. Best to limit one’s time, develop a decision-making process you’re comfortable with – and always maintain a healthy respect for the unknown.

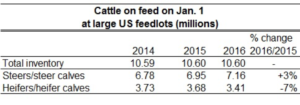

Added note: Friday’s Cattle on feed report shows more placements, more steers on feed

Friday’s report (Jan. 22) pegged the number of December feedlot placements at 1.53 million head, down 1% from the year-ago level. Ahead of the report, traders and analysts were anticipating a larger decline of 4-5%.

The total on-feed inventory included 7.16 million steers and steer calves, up 3% from the previous year, and accounting for 68% of the total inventory. In contrast, heifers and heifer calves accounted for 3.41 million head, down 7% from 2015 – clear evidence that American ranchers are holding back more females for breeding stock.

Now let’s watch and see what the market does with the news in the coming week and see how that affects our futures.

Browse our cattle feeds here.

Brought to you in partnership by: